Navigating the complexities of personal taxes can be a daunting task. Fortunately, there are resources available to ease the burden. This guide is designed to offer valuable knowledge for individuals seeking to simplify their tax filing. Whether you're a first-time taxpayer or a seasoned pro, these tips can help you ensure a smooth and successful tax season.

- Comprehend the essentials of personal income tax.

- Collect all necessary records.

- Employ tax software or seek professional guidance.

- Enhance your credits.

- Process your return on time to avoid penalties.

Maximize Your Refund with a Personal Tax Accountant

Navigating the complex world of taxes can be overwhelming, especially when it comes to ensuring you receive the maximum reimbursement. This is where a skilled personal tax accountant can make all the difference. These professionals possess in-depth knowledge of tax codes, and they're able to identify strategies to minimize your tax burden. A personal accountant can carefully review your financial statements, uncovering potential credits you may have overlooked. By leveraging their expertise, you can securely file your taxes, knowing that you're getting every dollar you have coming.

Mastering Tax Season through Confidence: A Personal Accountant's Expertise

Tax season can often be a daunting time. However, with the right guidance and expertise, it doesn't have to be. Engaging a personal accountant can provide invaluable support in navigating the intricacies of tax laws and maximizing your monetary outcomes. A skilled professional can examine your income, discover potential deductions and credits, and guarantee that your return is precise. This leads in confidence of mind knowing your taxes are handled seamlessly

- Benefit from personalized approaches tailored to your individual financial position.

- Minimize time and burden by outsourcing the complexities of tax preparation.

- Receive valuable knowledge about tax laws and how they influence your finances.

Investing in a personal accountant is an investment that can significantly enhance your financial well-being.

Tailored Tax Solutions for Individuals and Families

Navigating the complexities of tax law can be a daunting challenge for individuals and families. With constantly evolving regulations and unique financial positions, it's crucial to have access to expert guidance that tailors your specific needs. Tailored tax solutions provide a comprehensive framework to optimize your tax position. By carefully analyzing your income, expenses, and deductions, our team of experienced tax professionals can develop a system that minimizes your tax burden and leverages available benefits.

Whether you're an individual looking to minimize your tax obligation or a family seeking to structure for the future, our customized solutions are designed to provide you with peace of mind and financial stability. We offer a wide range of solutions, including tax filing, estate planning, retirement planning, and more. Contact us today for a here no-cost consultation and discover how our tailored approach can benefit you in achieving your financial goals.

Collaborating with Your Personal Personal Tax Accountant

Tax season can be overwhelming, but it doesn't have to be a challenge. Explore partnering with a dedicated personal tax accountant to simplify the process and maximize your tax return. A dedicated tax professional will analyze the complexities of the tax code, discover potential savings, and ensure that you are compliant all obligations. With their expert guidance, you can have peace of mind knowing your taxes are handled accurately.

- Perks of Partnering with a Personal Tax Accountant:

- Expertise and Knowledge: They have in-depth familiarity of the tax code and its amendments.

- Time Savings: You can concentrate your time to other valuable tasks.

- Reduced Stress: They handle the nuances of tax filing, alleviating stress and anxiety.

Proactive Planning of the Curve a Personal Accountant

Don't just react to tax deadlines—actively manage your financial future. A experienced personal accountant can help you in developing a personalized tax plan that reduces your liability while utilizing available incentives. From individualized financial structures to everyday activities, a skilled accountant can offer invaluable insights to help you overcome the intricacies of the tax code. Taking this step can yield significant benefits and give you peace of mind.

- Contact a professional today to discover how a personal accountant can optimize your tax strategy.

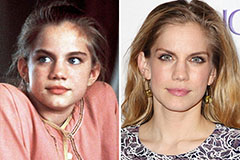

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!